I Did Good, Sir follows Jack Reilly from his earliest encounters with mentorship through his professional formation and adult life. Set largely within veterinary practice and rural environments, the novel explores how a sensitive individual learns to navigate authority, responsibility, and self-doubt. Through a series of reflective episodes, the story examines how vocation, care, and language shape a person’s understanding of worth and direction.

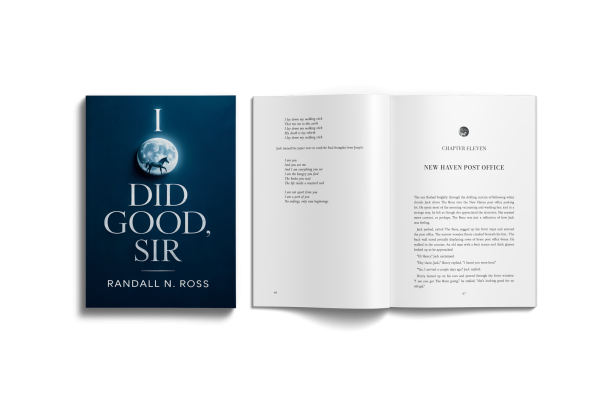

United States, 1st Feb 2026 – A new work of reflective literary fiction, I Did Good, Sir by Randall N. Ross, has been released and is beginning to draw attention from readers interested in inward journeys, formative mentorship, and lives shaped by service rather than spectacle. The novel traces the emotional and spiritual development of its central character through moments of apprenticeship, loss, and moral testing, offering a restrained examination of how identity is formed over time.

Ross’s novel centers on Jack Reilly, a sensitive and observant young man whose early encounters with authority figures, animals, and responsibility leave a lasting imprint. Moving between childhood, professional training, and adulthood, the narrative follows Jack as he navigates expectations imposed by family, institutions, and mentors, while quietly attempting to listen for a more personal sense of direction. The book’s title echoes a pivotal moment in the story, a simple phrase that reflects both approval and misunderstanding, and becomes a touchstone for the novel’s broader inquiry into worth, language, and intention.

Rather than relying on dramatic plot turns, I Did Good, Sir unfolds through scenes of attention and presence. Much of the novel is set within veterinary clinics, rural landscapes, classrooms, and transitional spaces such as cabins and roadways. Animals appear not as symbols but as living beings requiring care, patience, and humility, mirroring the protagonist’s own learning curve. The work invites readers to consider how vocation can function not only as a career, but as a moral practice shaped by listening, repetition, and accountability.

Early readers have noted the novel’s measured pace and its emphasis on interior experience. Responses have highlighted Ross’s refusal to offer easy resolutions, instead allowing moments to accumulate meaning gradually. Several readers have pointed to the book’s depiction of mentorship as particularly resonant, emphasizing how guidance is shown as imperfect, human, and deeply influential without being idealized. Others have remarked on the quiet tension between external success and internal alignment that runs throughout the narrative.

The prose style of I Did Good, Sir is deliberately unadorned. Ross employs plainspoken language and close observation, trusting the reader to engage with what is left unsaid. The novel’s structure reflects this approach, favoring episodic movement and reflection over conventional plot escalation. This restraint aligns with the book’s thematic concern for attention, a quality that Ross has described as central to both his professional and creative life.

In a brief comment on the book’s origins, Ross noted, “I wasn’t interested in writing a story that explains itself. I wanted to write something that stays close to how learning actually feels, uncertain, repetitive, and shaped by small moments that don’t announce their importance at the time.” That sensibility is evident throughout the novel, which resists categorization as either purely coming-of-age or professional fiction, instead occupying a reflective space between the two.

Although the novel is not autobiographical in a literal sense, it draws on environments and experiences familiar to the author. The veterinary settings, in particular, are rendered with specificity and respect, reflecting years of firsthand knowledge. These details ground the story while allowing it to address broader questions about service, competence, and the ethical weight of care. According to the book’s publication details, I Did Good, Sir is a work of fiction, and its characters and events are imaginative constructions rather than direct representations .

The book’s reception thus far suggests that it is finding an audience among readers who value contemplative fiction and narratives centered on moral attention rather than spectacle. Podcast hosts and cultural editors have expressed interest in the novel’s crossover appeal, particularly its relevance to conversations about work, calling, and the often unspoken emotional lives of those in caregiving professions. The novel’s themes also resonate with readers navigating transitions, whether professional, personal, or spiritual.

I Did Good, Sir arrives at a moment when many readers are reexamining inherited definitions of success and fulfillment. By focusing on the slow accumulation of understanding rather than decisive triumphs, the novel contributes to a growing body of literature concerned with inward development and ethical presence. Its questions are not framed as problems to be solved, but as conditions to be lived with attentively.

Brief synopsis

I Did Good, Sir follows Jack Reilly from his earliest encounters with mentorship through his professional formation and adult life. Set largely within veterinary practice and rural environments, the novel explores how a sensitive individual learns to navigate authority, responsibility, and self-doubt. Through a series of reflective episodes, the story examines how vocation, care, and language shape a person’s understanding of worth and direction.

About the author

Randall N. Ross was raised in Torrington, Connecticut, in a family shaped by work, routine, and quiet perseverance. Drawn early to animals and the people who cared for them, he pursued a career in veterinary medicine that included years of training, farm work, and clinical practice. He later founded Vermont’s first small animal mobile veterinary clinic, which he operated for more than three decades.

Alongside his scientific and professional life, Ross has maintained a long-standing creative practice. He has written song lyrics performed on national television, composed music staged off-Broadway, and published poetry focused on reflection and inner experience. These creative pursuits have informed his fiction, which often examines service, mentorship, and attentiveness as lived practices rather than abstract ideals.

I Did Good, Sir reflects this convergence of experience. While fictional, the novel draws on emotional and ethical landscapes familiar to the author, exploring how individuals learn to listen, serve, and continue becoming without certainty. Ross continues to write fiction that extends the questions introduced in this work.

Availability

Randall N. Ross is available for interviews, podcast conversations, and literary discussions related to I Did Good, Sir, including topics such as reflective fiction, vocation, mentorship, and the intersection of professional life and creative practice. Media inquiries and interview requests are welcome.

Media Contact

Organization: Randall N. Ross

Contact Person: Randall N. Ross

Website: https://a.co/d/hFNjRzO

Email: Send Email

Country:United States

Release id:40864

The post New Novel I Did Good, Sir by Randall N. Ross Explores Vocation, Mentorship, and the Quiet Work of Becoming appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section